Cost-of-living crisis: 1 in 20 young people running out of food

(https://globalnews.ca/news/7830437/mobile-plans-london-food-bank/)

With 36% of young people limiting their social life to save money, how will the UK thrive?

In today's economic landscape, the younger generation faces substantial challenges. This article delves into the most recent cost-of-living challenges, categorizing them into four sections: food shortages, job cuts with salary reductions, and skyrocketing rents. We will also explore potential solutions to address these pressing issues.

Shortage on food

Research from the House of Commons shows that the annual rate of inflation reached 11.1% in October 2022, a 41-year high, before easing in subsequent months. It was 6.8% in July 2023. The living cost has soared to the highest in history due to the rising inflation in the past six months. While the UK has recently managed to avoid a recession, young people are still facing living cost challenges.

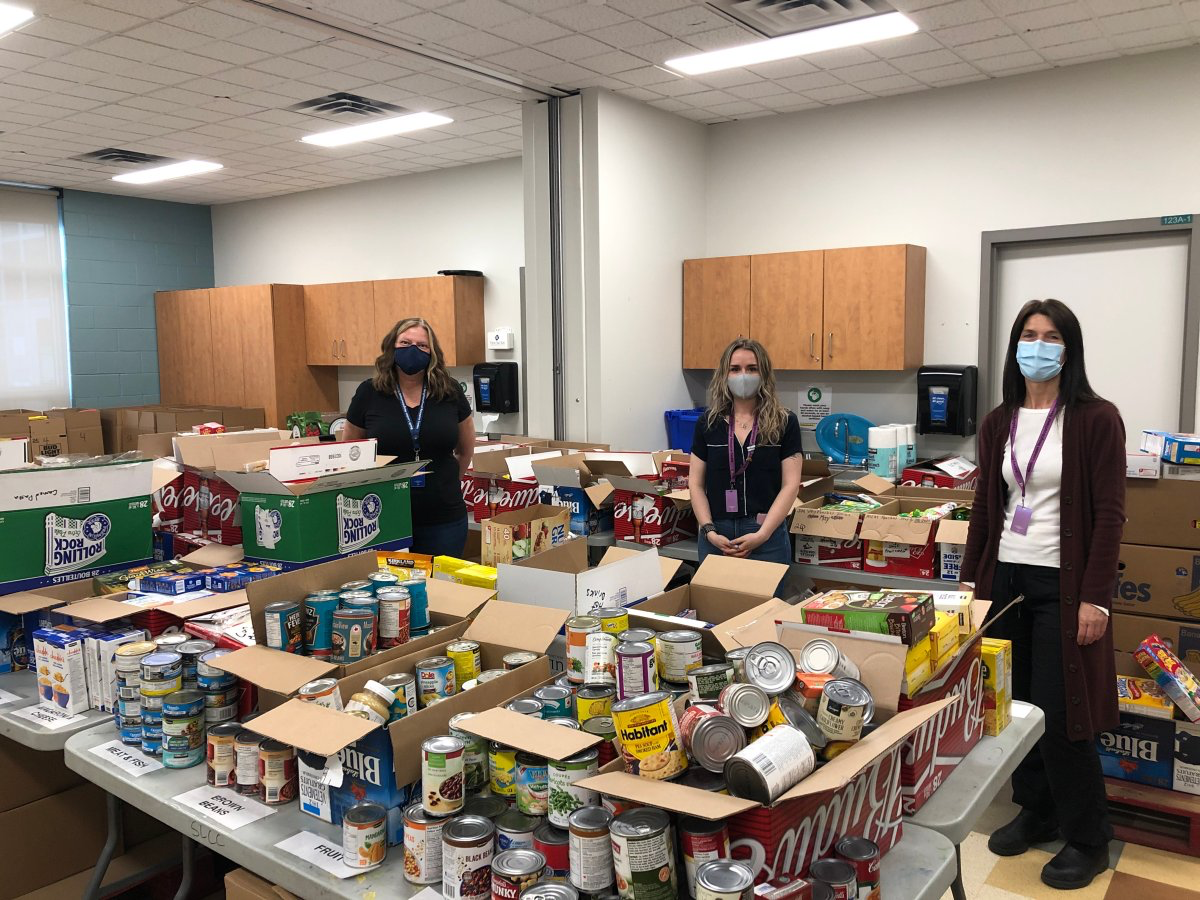

Food banks are also witnessing an increased number of young people requesting food and support. Official figures from ONS reveal around 1 in 20 said they had run out of food in the past two weeks and couldn't afford more. Many young people are having to give up their quality of life in order to save money.

Meanwhile, UK YOUTH highlights that over a third (36%) say they are more lonely as they reduce their social life to save money, while one in five (20%) say their access to regular meals has been negatively impacted.

Inflation held firm at 8.7% in May after striking a 41-year high late last year, while interest rates have been hiked to 5 per cent in an effort to drag prices lower. Under inflation, young people are receiving stagnant wages with growing living costs, including housing costs, and education expenses. ONS shows that people aged between 25 and 34 are 3.4 times as likely to experience financial vulnerability as those aged 75 years and over. These data showcase the negative impact on a huge numbers of young people, especially they are less likely to secure income through working full time.

Job cut with salary reduction

Worse still, the reduced job positions prevent young people from earning enough money to go through living cost challenges. The Bloomberg report shows that job postings are down almost a quarter from a fiscal year in the three months to June, indicating that a possible downturn that could lead to layoffs may be on the horizon.

Analysis by The Bloomberg Reed Jobs Report of advertised graduate roles on Reed Recruitment shows that the average salary growth began to slump just as price rises picked up pace, leading to real-term cuts for these workers.

In response, Ndidi Okezie OBE, Chief Executive of UK Youth, announced in the press release: “These figures must be a wake-up call for our country – our young people are struggling in the face of the cost of living crisis and they need help.”

“If we fail an entire generation of children and young people, we ultimately fail the future of our society. Politicians, funders, businesses – everyone must play their part. ”

Soaring rent

The rise in living costs has also resulted in soaring rent, which is another challenge for the young generation. ONS research reveals that private rental prices paid by tenants in the UK rose by 4.9% in the 12 months to March 2023, up from 4.8% in the 12 months to February 2023. Census data outlines people are taking longer to afford a home. Meanwhile, Zoopla says 42% of those 18-39 have given up on buying.

Although young people can receive loans from the government, the average forecasted debt for students in England who started their course in the 2022-23 academic year is £45,600 ($58,956) when they leave university compared with £15,000 for those who started their course in 2006-07. According to OECD analysis, the debt carried by students who study at English universities is higher when compared internationally, such as Norway. Throughout their degree, they also face cancellation of lectures due to the conflict between staff and University managers.

Living cost is affecting young people in different ways. “Cost of living hasn’t affecte me too much as my rent is fixed and I have a loan to cover it.” Said Alaster, an undergraduate student studying at University of Leeds. “Food is noticeably more expensive. I can no longer afford ice cream in my weekly shop.”

What can we do?

Reflecting on these challenges, David Ainslie, the ONS Principal Analyst said: “Today’s analysis adds to our work identifying inequalities in society, and how certain groups have been more affected by the increased cost of living than others.”

It is important for our government to take swift actions to support the youth. For example, more policies supporting young people buying their first house could boost the confidence, especially the mental health of young people, according to Mental Health Foundation. Government can work with estate companies to provide cheaper flat or house, with less interest rate. For example, this could reduce pressure on young people going without, working extended hours or skipping a social life to save more money etc..

Secondly, it will be helpful for the government to work with restaurants to provide affordable food menus, such as lunch deals for young people. This can prevent the lack of nutrition issue that would lead to future health issues and unproductive on work.

Lastly, a survey by Prospect highlights that young people are under-prepared to get into the employment market because they lack skills and knowledge in terms of what industry they want to enter. Governments and companies should provide programmes to support young people in exploring and getting into the industry they want, especially those from minority backgrounds. This can prevent them from facing financial challenges.

Overall, young people are struggling significantly under the cost-of-living crisis, and they need support from the government, especially on essential food, employment skill leverage, and house purchasing. In my view, young people hold the key to the future of the UK. I believe that if young individuals are relieved of the burden of high living expenses, there is a potential for substantial economic growth and a significant uptick in their participation in the labour market.

0 Comments