Could you first introduce yourself to the reader?

I’m the Communications and Marketing Executive at Starling Bank, a UK app-only bank. I grew up in Scotland and went to Durham University to study History of Art and English Literature, graduating in 2017. I never expected that I would get a job working in a bank but then again, Starling isn’t like other banks.

Tell us a little bit about your job?

No two days are the same at Starling but for the most part my job is all about sharing Starling’s journey. That might be through writing and formatting copy for the website or blog, doing award entries, answering questions from journalists, building partnerships, helping to arrange events, merchandise or campaigns for social media, as well as speaking to customers about their businesses or how Starling helps them manage their money.

What was your career path to becoming the Communication and Marketing executive of Starling?

I first heard about Starling in October 2016 from a friend at uni who had spent the summer as one of Starling’s first interns. He told me that he had been working in ‘FinTech’ to which I replied ‘what’s that?’ He told me about the Financial Technology sector (shortened to FinTech) and Starling’s app-only current accounts, yet to launch at that point. I loved the idea of a company founded by a woman who wanted to do something completely different and change how we manage our money.

I sent in my CV, went through the interview process and was one of about five people accepted onto the summer internship programme. Long before starting the internship in July, I had booked two trips - one to South America and another to Australia, New Zealand and Asia. And so when it came to talking about a permanent position at Starling, we arranged two contracts - one between the two trips and one for when I came back.

You’ve had a number of internships, do you think that they are useful for a young person?

Absolutely. You learn so much even from a few days of work experience. And learning what you don’t want to do can be just as useful as learning what you do want to do.

Before Starling, I had done work experience in retail, PR, research and head hunting, all of which I enjoyed but hadn’t fully clicked with. I’ve found that I prefer working for a slightly larger company with a product that I can fully engage with rather than working for an agency or company with many different clients.

What do you love about your job?

I love the fluidity of my role and the level of responsibility everyone has in a young company - no coffee runs for interns, everyone has to pull their weight and make things happen.

I also love learning new things each day about an industry that I knew next to nothing about when I started my internship. I began in Payment Services which is the business to business part of the bank. When you ping someone money and it comes through in a few seconds this happens through the Faster Payments Scheme. Starling became the first challenger bank to become a direct member of Faster Payments and there are still only 21 members which means most companies will need a sponsor, such as Starling. Payment Services is therefore our way of opening up these payment rails to other companies that need the service.

One of my tasks was doing an award entry for Payment Services. As an English student, writing comes naturally to me and when we moved office in August, I ended up sitting with the Head of Communications and helping her with all award entries for the company, press releases and statements for journalists plus merchandise and events with other members of the Marketing team. During my internship, I also worked with HR to help write job descriptions and organise interviews.

Working in several parts of the company has been invaluable and I’ve learned where my strengths are and where I can add most value.

What are some of the challenges?

The pace of change is one of the best things about Starling as well as one of the challenges. It’s non-stop and you’ve got to think on your feet, get things done quickly and be proactive. For people who like structured management, such a dynamic workplace might not suit them but I liked the ownership over projects and lack of hierarchy within the company.

At Starling, we’re generally interested in people’s attitude to work rather than a list of credentials - it’s aptitude over experience. Without that approach, I doubt I ever would have been offered the summer internship in the first place. Nothing about doing an Art History and English says banking or tech. However, I’ve always loved tech and designed my own online gallery (www.upward-onward.com) and spoke about this in my interview. I think I also benefited from Starling not having numerical tests as part of the application process. I did maths for the International Baccalaureate but that part of my brain was rusty to say the least almost 4 years on. It was only when I got to Starling that I realised how useful my degree could be - every company needs writers and creative thinkers.

And what has been the highlight of your career to date?

At 22-years-old, I’m very early on in my career but one highlight at Starling was winning that first award I wrote the entry for. I think I was in South America when it was announced and I received a message from the Chief Operating Officer to say that Starling Payment Services had won for their category at the Payment Awards. This year, we’ve gone from strength to strength: Starling has been named Best British Bank at the Smart Money People Awards, Hottest FinTech of the Year at the Europas and Best Use of Mobile at FSTech.

How does Starling differ from other banks?

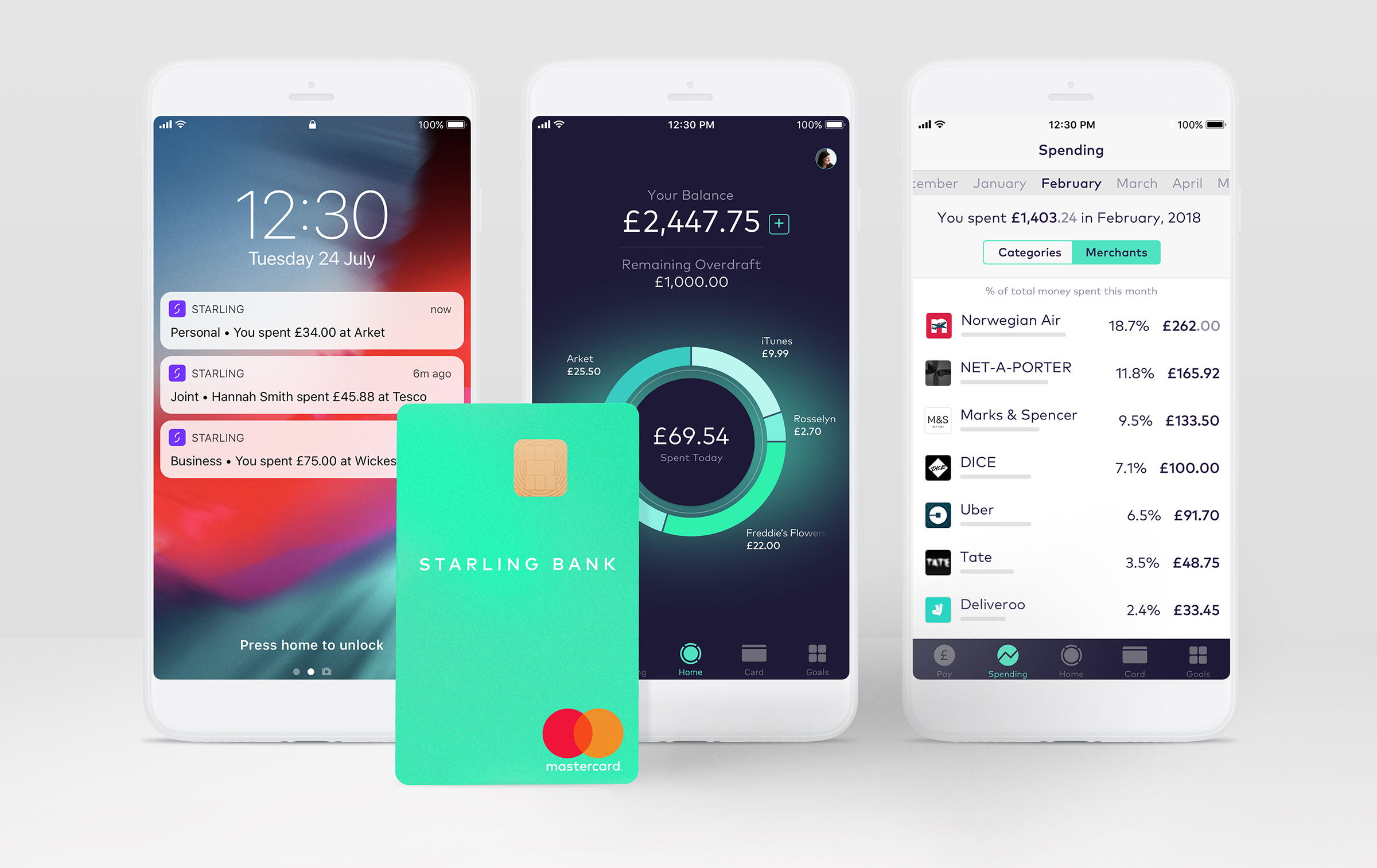

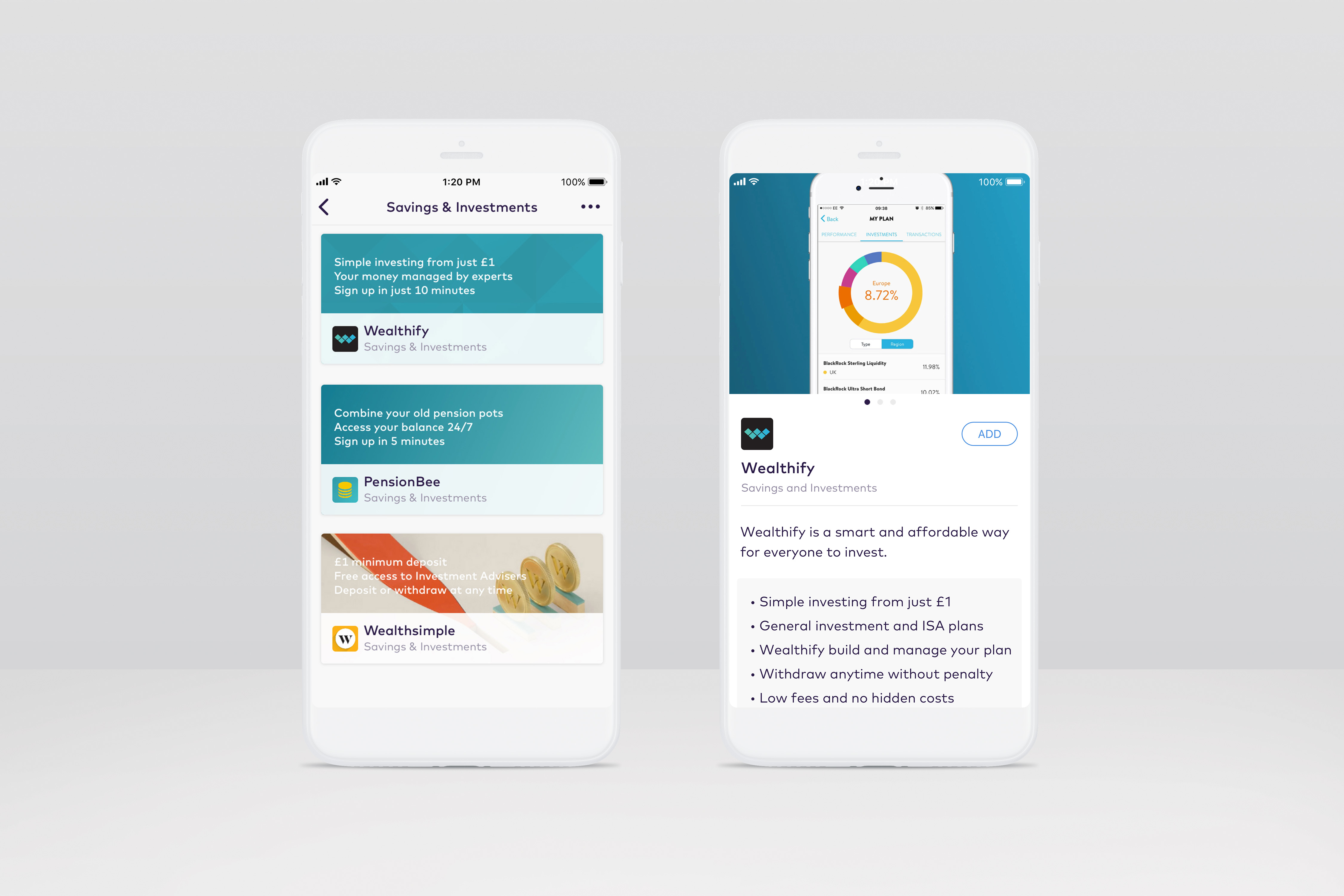

Everything can be done from one app - all your everyday banking plus accessing other financial products such as ISAs or insurance through our Marketplace. We’ve built the entire bank from scratch to do this and so technology is integrated at all levels across the bank. We work in a way that’s much more similar to tech companies than banks: we’re updating software, improving features and bringing out new ones all the time. We don’t have to adapt to a digital world - we were built for it.

Other than tech, the other main difference is the focus on customer experience. For years, there haven’t been any real alternatives to banks that up-sell their own products and charge fees at every opportunity rather than thinking about what’s best for consumers and businesses. For many people, myself included, Starling has the ability to transform the way you think about and manage your money. And because Starling is a fully licensed, regulated bank you have the same security and protection you would have with a high street bank.

Is there anything you keep in mind when working on marketing for a ‘challenger’ bank?

There are so many things to think about but one of the main things is identifying the pain points of traditional banking and sharing real life scenarios where we can help our customers.

For example, we’ve just launched loans which has a ‘Spread the Cost’ feature which allows eligible customers to take out a loan after they’ve bought something. Traditionally applying for a loan involves miles of paperwork and a meeting with a bank manager who goes through your credit history step by step. But with Starling, you can apply for a loan all from the app. Say you’ve bought festival tickets for yourself and a friend, you could take the pressure off your bank balance by spreading the cost over a few months and paying it back in stages. There are no set-up fees or early repayment charges, just a simple interest rate of around 11.5% for what you borrow, which should work out being less than the interest on an overdraft.

Challenger banks are all about taking some of the stress out of money management and making everything easy to understand and fair for the customer so this is what we focus on communicating.

Do you think there is anything that banks can do to help people who are living paycheck to paycheck?

First of all acknowledging how hard this is and listening to what customers need. And then building the product around this.

At Starling, we try to provide digital tools that act as a safety net when they need it and help customers identify where to save money that they can set aside in savings. For example, an overdraft with Starling is completely flexible - you only pay interest on what you borrow and you choose how much you want your overdraft to be (up to the limit we set when you first apply for an account).

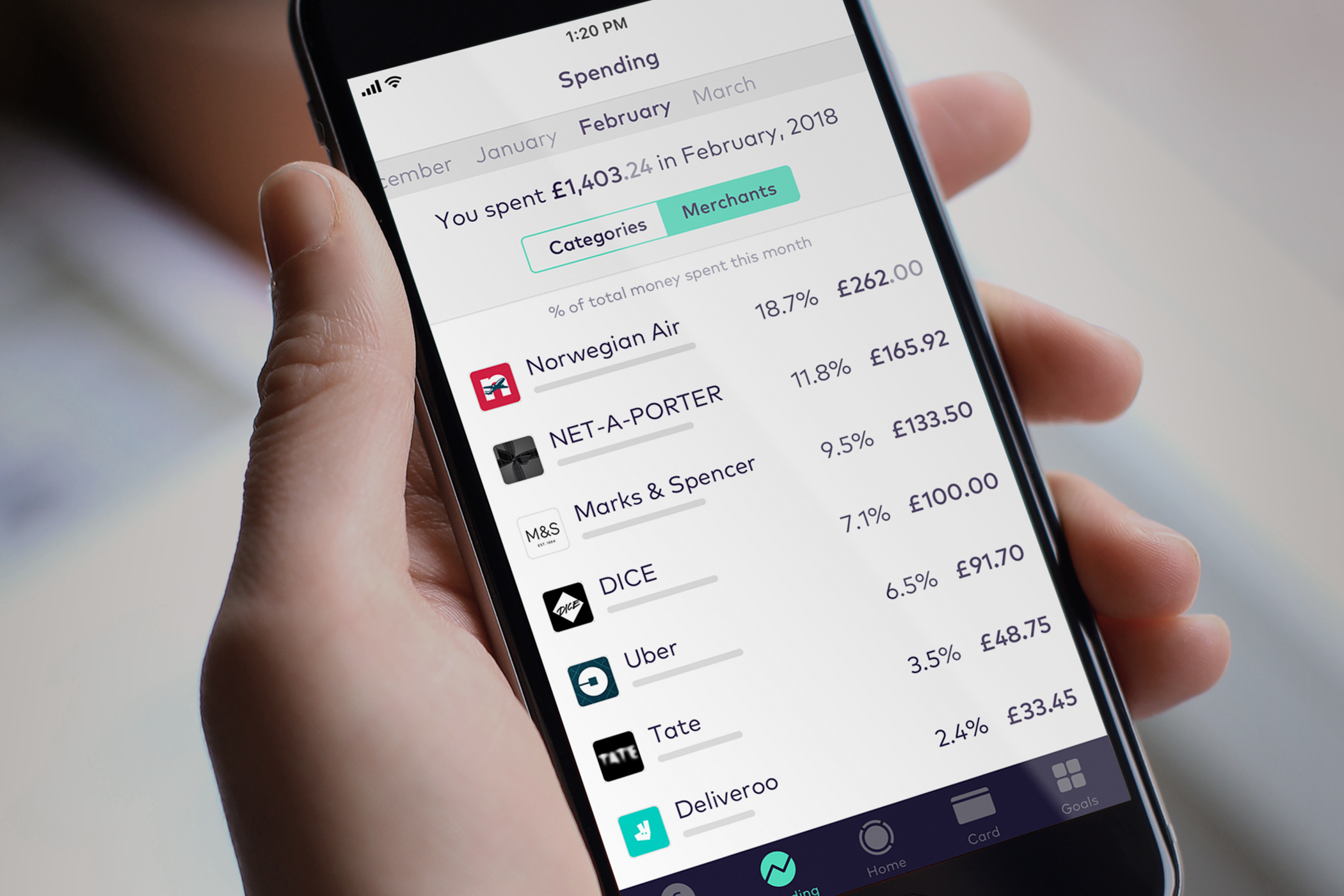

Spending Insights break down what you spend where each month and therefore helps to identify where you could save. Savings can be set aside as a savings Goal which is kept separate from your everyday balance and therefore can’t be spent until it is moved back, which you can do any time if and when you need it. This way, savings are kept separate but are still visible and accessible.

We also send you a notification if you have a direct debit due to come out of your account and there isn’t enough to cover it so that you can top it up and avoid being charged for a late payment.

All of these features are designed to give you more control over your finances. Financial literacy is something we’re passionate about and we share research and advice through our blog.

What are some of your top money saving tips?

The main thing I do is to put at least half of my salary straight into a savings Goal. This means that I keep my everyday bank balance at a level where I’m not so tempted to go and spend lots of money and then when it gets low, I simply move money from the savings Goal back into the balance. The other tip for saving would be to download MoneyBox which rounds up purchases into an ISA eg. if you buy a coffee for £2.40, 60p will be invested.

I would also say try not to be embarrassed about asking for money back that you’re owed, which can also be made easier with Starling with Settle Up - this feature allows you to send a request or split a payment from the app and send it as a message to friends or family.

Do you think working in financial services is an appealing industry for young people today?

From the conversations I’ve had with friends, working in financial services and working in financial technology sound quite different. It’s down to individual which industry they find appealing and internships can help you get a better idea of different industries. The pace of change and more informal start-up culture of FinTech suits some people while others may prefer more established, corporate companies with rotational graduate schemes.

What is something you’re most excited to see come to the industry?

More machine learning. The Starling Marketplace, which gives customers access to third-party financial products and services, is already saving so much time and paperwork usually required to take out a mortgage or start investing. In the future, it will become increasingly smart so that with the customers permission, Starling will analyse your account and recommend products and services that are best for you.

If you could give one piece of advice to 16-year old Charlotte, what would it be?

They’re not lying when they say your job doesn’t exist yet. When I was 16, Starling hadn’t even been founded.

And what advice do you wish you had been given when entering the industry?

It will not be what you expected. Never-ending hours, lack of innovation and creativity and only being concerned with making money were part of what I expected working in a bank and I have been proved wrong.

Finally, how could a young person follow in your footsteps?

Know your strengths and don’t be afraid to apply for a job you think you aren’t qualified for. Research has shown that men will apply for a job if they have 60% of the requirements while women tend to apply when they have 100% of the requirements. I know from hiring the next round of interns that there is a gender imbalance in the number of applications companies like Starling receive and if we are going to change the gender imbalance in the industry as a whole, encouraging more women to apply is key. The opportunities are there - it’s up to you to take them.

Charlotte has an account on Voice where you can read more of her content. You should also check out The Figure, a weekly podcast Charlotte co-hosts with life-long friend Georgia Parkin.

0 Comments