Being self employed is easier than some think. It's often referred to as being a freelancer too. It offers excellent flexibility to choose what work you do and saves you doing all the registration paper work with every new employer. This guide gives you some top tips and should help get you through your first tax return.

What is tax? How do I pay National Insurance? Who do I tell? A few questions that it's useful to know the answer to. So let's not beat around the bush, let's address them. I assume here that you're wanting to be self employed. That means you must be 16 years old at least.

- Should I form a company?

- What taxes do I pay?

- Where must I register?

- What records do I keep?

- When do I submit a tax return?

- Should I get insurance?

- How do I invoice people?

- What are expenses?

- What does the tax return need from me?

- Where do I find work?

- Should I set-up a website?

- Where can I get more help?

1. Should I form a company?

That depends. If you're planning to run a business with other people its probably a good idea because then you can each take shares to show percentage of ownership. But then you've got a few more things to consider around fostering as an employer.

There's also an option to form a partnership. The main benefit of a company is a few extra legal protections like liability for money and its easier to hand over control or running of your business in future. But then all this can be determined by contracts and other agreements. Here's some more information about other business types. For the rest of this guide I'll assume you're a self employed creative (sole trader) rather than a company.

2. What taxes do I pay?

National Insurance and income tax. Like everyone else. But the main difference is that you tell HMRC (the tax people) once a year how much you've earned and they tell you how much to pay them. That could include student loan repayments too if you went to university. You don't pay anymore than your friends who work for someone else. And actually you can claim back expenses that they can't - like a proportion of your rent and bills if you work from home, your phone contract etc. Stuff they can't. So arguably you will pay a little less tax even if you earn the same as them.

Here's a page on the HMRC website with tax rates.

Remember you pay once a year, so save as you earn to avoid a surprise bill you can't afford.

3. Where must I register?

You must register with HMRC as soon as. You can do that on this site: https://www.gov.uk/log-in-file-self-assessment-tax-return/register-if-youre-self-employed

It might be worth registering with a professional body or association relevant to what you do also. People like BECTU - a union - is great for offstage workers and you can get insurance with them too. I also recommend being a part of the Federation of Small Businesses (FSB).

4. What records do I keep?

Everything you can. Keep hold of every receipt for things you buy. And of course you should keep a record of every invoice you send. I personally still use a spreadsheet for these things - a log of everything I buy and a log of all invoices I send. I also scan all the originals in to folders on Dropbox. You can also use online accounting systems like Xero.

You might find it helpful to open a separate bank account and even take out a separate credit card. That's also what I do. It helps separate business expenditure and income from personal. Then you can pay yourself some money each month to your personal account for day to day life. Remember to put savings aside for your tax bill at the end of the year. I personally try to put 25% of all income aside for my taxes - its a rough estimate that seems to work for me.

Sarah-Jane Watkinson, a UK Theatre Producer, has also created a simple to use Google Spreadsheet that helps you record what you need and gives a guidance as to what your tax liabilities will be. It was updated to reflect financial year 2016/17 tax rates, and in future you can adjust those to help. She's not an accountant or tax adviser, but a very nice person who's made a tool available to those, like her, that just need to do it. Download the spreadsheet here (for Tax year 2020-21)

5. When do I submit a tax return?

After every tax year end. Remember; it runs from the 6 April to 5 April the following year.

The absolute deadline to file your return and pay any monies due is 31 January of the year following the tax year end. For example, if you go self employed now then your tax year end will be 5 April 2018 and you must file a tax return by 31 January 2019 (assuming you do it online).

Although be aware, there's currently movement towards you making a filing four times a year. The details of this are yet to be announced. But it's yet another good reason both to join the Federation of Small Businesses and register with HMRC so you get updates direct from them about when you should be filing income and expenditure details.

6. Should I get insurance?

Yes!

There's a few types you might like to consider:

- Public Liability Insurance - essentially if something you do causes injury or damage to someone else or their property. You should almost definitely get this.

- Professional Indemnity Insurance - if you're giving out advice then this is good to have in case your advice leads to something unexpected or unpleasant.

- Employers Liability - only relevant really if you're going to employ anyone (including volunteers) directly. Probably not needed if you're an individual creative.

- Contents/Personal Belongings Insurance - is your laptop critical to your work? What happens if you break it? Lose it? Have it stolen? Same for your phone. These might be covered by your normal home insurance so do check. Or you can get specific cover. You might also try 'added value' bank accounts to cover your phone.

- Travel Insurance - if you're going to work abroad, make sure you're covered, and. Make sure it allows you to travel for work.

- Cyber Protection - especially if you're a digital creative - are you insured for data breaches or hacks?

- Legal/Tax Protection - this is insurance to help you with legal matters or if HMRC investigates you. It might also provide cover for days you're on jury duty and similar such issues. You can usually buy with your liability insurance, or you get it as part of membership to the Federation of Small Businesses.

- Income Protection Insurance - what if you can't work through illness? Could you pay your rent and other bills? Income Protection insurance is a must if you don't have any other safety nets - it means that after a certain period (usually 1-3 months) you get a regular payment.

- Life and/or Critical Illness Insurance - this is also much broader than just being self employed. If you get a serious or critical illness, have a limb amputated, or indeed pass away then could you or your loved ones cover the associated costs of care or the aftermath? I'm sorry to be so blunt. But there are lots of companies out there which help.

See, it's not scary. And there's plenty of brokers and friendly insurance folk out there. Let me break down a few options, And remember there are plenty of other similar options only a few clicks away on your favourite search engine.

Public, employers and cyber liability + professional indemnity Insurance is often bought together. Sometimes known as 'business essentials'. Take a look at a business insurance comparison websites like Money Supermarket or Compare The Market. You might also try Policy Bee. And do also check out the A-N artist information network. Their creative professional insurance looks great. You can become a member and then take out the policy direct with Hencilla Canworth. If you're an organiser as much as a maker, then ensure you explore the arts organiser membership/insurance. It's got great levels of cover across a range of creative disciplines. Not just visual artists. If you're a tech or related professional - then take a look at the insurance via BECTU.

Travel and phone insurance - can often be purchased through comparison websites, with your holiday/phone or is usually a benefit of added value bank accounts like the Nationwide Flex Plus account.

For personal belongings - check your home contents insurance. Otherwise you can probably add it to your liability insurance policy.

For legal/tax protection - check what your liability insurance offers you. But do also join the FSB to get a full range of cover. Another option is the Association for Independent Professionals and the Self Employed.

For income protection, life and illness cover then you should speak with an IFA - an Independent Financial Adviser. In this case they're a bit like a broker (like Policy Bee above). But they really look deep at your personal circumstances and needs should anything happen. Usually you shouldn't have to pay them anything either - they will earn commission but a good one will always recommend the best option for you - not what earns them the most. I'll recommend you mine if you drop me an email.

And don't forget car or van insurance if you use one for work! Make sure you have business use cover, not just 'social, domestic, pleasure or commuting'.

All in all that's potentially 3-9 separate polices but just get what you need. If you're just starting out - you probably only need a policy that covers your laptop and public liability. Your phone/travel/car/illness insurance is probably something you already have sorted for general life.

And if you're starting out and think you'll be lucky to earn more than £20k a year - I'm sure you shouldn't be paying more than £30 a month at most for your liability and indemnity insurance. Probably half that if you focus on lower risk activities.

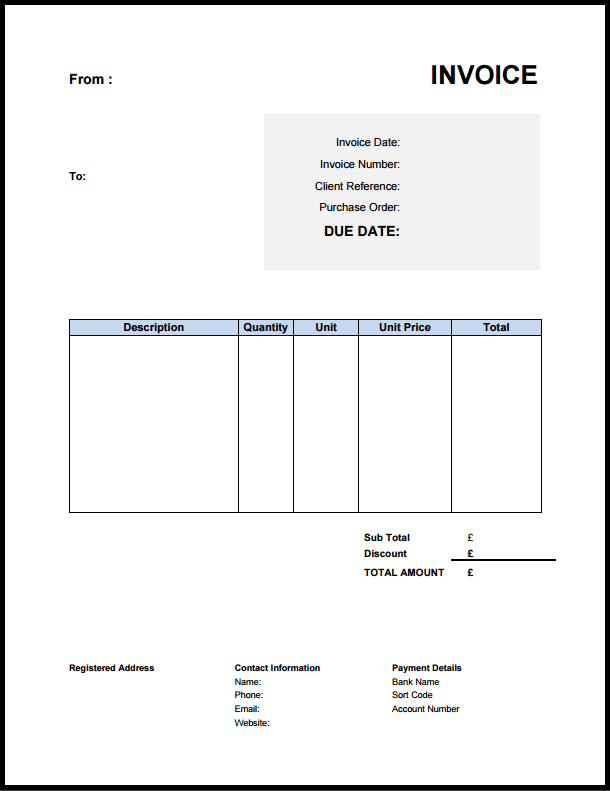

7. How do I invoice people?

An invoice is a document that stipulates the work done, the amount they owe you, when and how they should pay you. You should send one for each agreed invoicing stage (which might just be after each day or week of work done). It is very common nowadays to just send these electronically via email. But make sure you get the right email address.

It's important you include any details they (the person or organisation) ask you to include like a Purchase Order number (if they have one), a particular line description or other reference which helps the organisation know what pot of money you're being paid from. Some can even be picky about the address you put - remember it's usually the organisation's finance team address you need to bill - which could be different to where you're working.

So what do you put on your invoice?

- Your own name and address

- Your own Unique Tax Reference number (UTR) which you'll get from HMRC when you've registered above. [You should be able to use this instead of your National Insurance number, but again some organisations might ask for your NI number too]

- Your own invoice reference (I use Initials, Year, Inv# i.e. EG2029 - others use an organisation abbreviation and number i.e.. YTR002) - This should be unique on every invoice you send

- Your contact details (phone / email)

- A line for each bit of work being claimed - whether that's a project fee or hourly rate. For example "Youth Theatre Leader 8th, 17th & 25th October 2017, 2 hours each at £25 per hour. £150."

- The total to pay

- The date of the invoice

- The date you expect to be paid

- The details of how to pay you (Usually your Bank Account Name, Sort Code & Account number)

That's it. You could also include something about where to find your terms & conditions or the fact you reserve the right to charge interest for late payments under the Late Payment of Commercial Debts Regulations 2013.

You could make this in a simple word document or use something like Google Docs. For inspiration on how to layout your invoice just check something like Google Images for lots of examples. There's also a few downloads at https://www.zervant.com/en/news/free-uk-invoice-templates/.

You could also try using cloud invoicing or accounting apps. A few to look at include:

Remember - try to send your invoices always as a PDF. Keep a record of the sent invoices and whether you've been paid or not - chase them up if you haven't been paid within a month.

Many online software providers are also offering ways for you to take cards or use PayPal for payments etc. That is fine if you'd like, but do remember that there will always be transaction / withdrawal fees so consider whether you want to pay these. If you're selling work to consumers then the late payment act doesn't apply and you might want to allow card payments for upfront purchases.

8. What are expenses?

They're all the things that you buy in the course of operating your 'business' as a self employed creative. That could include work specific clothing items, pens, ink, computer software, some meals whilst travelling for work, and of course transportation. The HMRC have a pretty good guide to what is allowable on their website.

Remember - keep a record of all your expenses. Save your receipts (digital and physical) and then you can add up your allowable expenses at the end of the year to include on your tax return.

9. What does the tax return need from me?

Put simply it wants to know how much you've earned and how much you've spent on your business.

Whilst I suggest filing your tax return online, you could take a look at the downloadable paper versions now to see what it asks you. There's a document and a guidance document at: https://www.gov.uk/government/publications/self-assessment-tax-return-sa100 - you put the total amount you earned in the year in Box 17 and the total amount of allowable expenses you spent in Box 18.

It will also ask you how much interest you earned from savings and whether you had income from other sources in the year like other employment. If you've got a bar (or any other) job too and they pay you under PAYE then you need to find your latest payslip/P45 and use the details from that.

So it's a case of filling in your personal details, saying how much you earned and how much you spent, copy and pasting over any extra income you had (and tax paid), filling in your bank/payment details and tick a few boxes - answering no to most questions probably (read the questions as to what the correct answer for you is!). Then submit. If you've kept good records then it can all be done in a matter of minutes.

But I suggest you get yourself and adviser if not a full on accountant if your affairs get a bit more complicated or you want the peace of mind of someone else double checking things and doing the grunt work.

10. Where do I find work?

Quite a question! First things first, network. Get out there and meet people. Depending on your area of interest there will be meet-ups in your local city at some point. If relevant, you could try local business breakfasts. If you're more in the community sector or theatre rather than business orientated then attend events, make yourself known in the relevant circles.

Get your online presence up to date and make sure you're making the best representation of yourself online. I discussed this recently so do take a look at the other article for more details. This includes getting on to online network groups for film makers, artists, producers or youth theatre leaders for example. You can find groups on both linkedin.com and facebook.com.

Next up, look at jobs listings sites. There are often plenty of places advertising for freelancers, sessional workers or project by project creatives. A couple would be:

- Arts Jobs

- Stage Jobs Pro

- We also have a much longer list of useful arts websites here.

11. Should I set-up a website?

If you're a freelancer offering a service or selling your products then you might consider doing that online. It doesn't have to be complicated.

There are platforms like wordpress.org or wix.com, although I always recommend a professional image with your own domain and an email address. There are lots of big companies offering various deals. You can also head to https://cahost.co.uk where you can order hosting for £14.99 per year and a UK domain for £6. You can have a few emails set-up too and that's all for less than a coffee each month. To get that price just order a year's personal hosting package and enter the promotion code VOICE. You can then set-up your own Wordpress site which is completely customisable or use another website platform of your choice.

Just a few pages about who you are and what you do is needed. Keep it simple, showcase case studies or examples of your work and even embed a video or two. Then you can promote your site and allow people who are searching for your services to find you. A few very different examples of professionals doing this include: Mine, Stuart Mullins or Felicity Woolf.

12. Where do I get more help?

Well, start off with speaking to friends online & offline. Also try the above list of useful arts websites. You can also try looking at the creative mentoring projects we've found.

Advice and information can be sought from a relevant trade union or professional association. Finding groups like above online is not only a good place to find jobs but also to ask for help and advice from more experienced professionals.

And of course you can ask questions in the comments below.

[This article was first published in 2017]

A note on the author

Emrys has been self-employed since October 2006 - over a decade. It's not professional advice. For that you should speak to an accountant, or perhaps call HMRC at least. Emrys also runs Cloud Artisans - who he links to above for registering a website. He is the Business and Projects Manager for Upstart Projects - the national charity that runs this website. His portfolio career in digital & arts project management as a self-employed creative is what he's using for this article. Oh and he's been an adviser, local, regional and national judge for Young Enterprise over the years so keeps a foot in the developing young people in business side of life.

0 Comments